There's an OECD report I peek at occasionally that concerns itself with the neutrality of the tax transfer systems across the various OECD countries (it's

here if you want to look at it). The neutrality they are referring to relates to the way the tax-transfer system treats couples, or more specifically, the difference in financial outcomes between couples with the same household income but different distributions of that income across the couple (eg, single earner (100:0) versus joint income (50:50) couples). I must confess, even after reading it quite a few times I'm not really sure what they think is a neutral system.

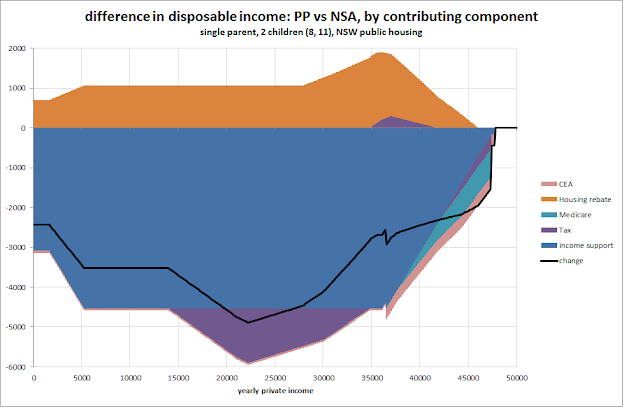

In earlier posts I've referred to a noticeable shift in the Australian tax-transfer system toward preferencing two-earner couples. I've illustrated this via charts showing the change in disposable income over the course of the current Government (ie, since the August 2010 elections) for 100:0 and 50:50 couples. Anyway, the OECD article makes me want to do it again, but using a different charting approach.

Obviously, couples can have rather different distributions of income than just 100:0 and 50:50 which made me think it was worth trying to cover all possible combinations rather than some of the traditional splits. So, the charts that follow show outcomes in August 2010, March 2012, and the change over this period.

Before getting into them, however, I should mention an assumption that I'm using. There's a common, and in some ways quite justified, criticism of comparisons between 100:0 couples and 50:50 couples (or other combinations). In essence it says that these households are not really comparable because of "hidden" or uncounted income that exists in the 100:0 situation. The 100:0 household has a full-time at home partner who, it's assumed, does the housework and other forms of domestic production, and when not doing that has some hours of leisure time. In contrast, the 50:50 household has no-one at home and housework, etc, has to be done in out-of-work-hours time (with less leisure).

There's an assumption in this though that's not stated. It assumes the 50:50 household has two full-time workers. That isn't necessarily so. Personally, I find the assumption irritating simply because my own experience when I had young children was, most of the time, for my wife and I to both work part-time at 50% hours. Our domestic production was the same then as in some other periods where one or the other worked full-time with one of us at home full-time. At the time we did do some comparisons of the difference in tax-transfer outcomes between our 50:50 and 100:0 arrangements, made a little easier because the only variable that changed was the distribution of hours worked.

So, I'm assuming in the stuff that follows that the members of my couple are equally interchangeable in terms of wage rates, their capabilities around domestic production, and their enjoyment of leisure time. After all, I'm trying to focus solely on changes in the tax-transfer system - I only want to alter one variable (income distribution). At 100:0 the couple is one full-time worker and one full-time at home; at 50:50 both are working half time.

With that out of the way, here's how the system looked at the start of the current Government. It's a childless couple, both aged, say, 30. The chart will probably perplex all those who look at it, but I'll explain how it works after you've had your initial shock...

Chart 1: Percentage difference in disposable incomes for different allocations of gross income at various levels of household income - August 2010

(click for larger view)

So, how do you read this...thing? First, the household income (the combined income of the couple) is found along the right hand side. The distribution of that income is chosen from the bottom axis, which shows what % of the income is in the hands of Partner 1 (or P1). Where the household income and the percentage allocation intersect there will be a colour. The scale on the right gives a value for the colour, which is the % by which the income of the couple of your choice varies from the income of a 100:0 couple at that same household income.

For example, at a household income of $70,000, we find that a 50:50 couple is in the light green zone. Light green tells us that this distribution of income gives 10% to 11% more disposable income(ie, after tax and transfer imposts) than a 100:0 couple would get from $70,000 income.

Where the income is low enough, income support payments (in this case Newstart allowance) have been included.

The picture is symmetrical around the 50:50 vertical line simply because both partners are the same. It wouldn't be quite so symmetrical at low incomes if, for example, I had made one partner an age pensioner and the other a Newstart recipient. Maybe later!

We can see from this that households where both have some level of income do better than 100:0 couples. No surprise there really; the fact that our system favours two income households in this way has long been used by accountants for small business couples to split income in the most favourable way.

So, now for March 2012...

Chart 2: Percentage difference in disposable incomes for different allocations of gross income at various levels of household income - March 2012

(click for larger view)

Here we see that two income couples have hit a purple patch, quite literally. For example, at combined household incomes from roughly $55,000 to $85,000, a 50:50 couple is 14% to 16% better off in net disposable income terms than their single income equivalents. This is quite a noticeable shift in the extent to which the tax-transfer system is favouring two income couples.

The last chart simply shows the difference between the two sets of results. For example, if the gain in 2010 was 5% and is now 8%, the 3 percentage points difference is shown on the chart. Doing this highlights which income ranges and distribution combinations have done best over the period since 2010.

Chart 3: Change in percentage points from August 2010 to March 2011

(click for larger view)

From this it seems the biggest winners, at least in percentage terms, are in the middle of my plotted data, from about $35,000 to $55,000, and cover splits from 50:50 out to about 80:20. I use winners advisedly - much of this gain actually comes from reductions in the incomes of single income couples as a consequence of the removal of the dependent spouse tax offset for this group.

(Incidentally, does anyone else see a brooding creature in the dark red? A bat perhaps? I'm reasonably sure that despite what some people say about the blood-sucking tax system, it's not really there!)

These changes are, of course, consistent with the aim of increasing workforce participation of potential second earners. It will be interesting to see how much further, if at all, this biasing toward two earner households can be pushed in the design of the tax-transfer system. What is missing in this analysis though, is households with children. The picture there is likely to be quite different because of the way Family Tax Benefit Part B works. Perhaps I'll tackle them another time.

Addendum

I forgot to mention that in calculating the change from 2010 to 2012 I converted the 2010 results to current $ values. And all calculations are my own, which is perhaps a shame as I can't blame anyone else for any errors.